Part I: Insurance is the batteries and they aren’t included

The insurance industry is broken.

The insurance industry is broken.

You have probably felt this brokenness in your gut whether you’ve worked for or interacted with insurance companies, but what you may not know is exactly how and why insurance is broken. You likely feel insurance is a lot of work to shop for and switch to, and that your price is destined to climb rapidly no matter where you go. You may be anxious that you didn’t buy the right coverage or that the insurance company might not pay that future claim. For twenty years I’ve watched this brokenness until it reached the point where I began to lose sleep and I felt compelled to quit my job, build Branch, and solve the problem.

You’ve likely heard Branch say that when insurance was first created it was meant to be a force for communal good: a way for neighbors to band together to protect one another from financial disaster. Yet somewhere along the line, insurance lost its way with rising costs, complicated policies, and marketing warfare. Branch Insurance was built to fix that.

Today’s giants were a product of a disruptive period about one hundred years ago. Companies like State Farm, Allstate, Farmers, Nationwide, and others gained their market share because they offered a similar product for significantly less money relative to their own incumbents. But as insurance companies became big, their innovative model became the standard model. Amazingly, after a hundred years and hundreds of competitors, the 1920s model remains unchanged and consumers bear a higher price as a result. Happy 100th birthday, State Farm! 🎂

You’re in Good Hands. Save 15% in 15 Minutes. Like A Good Neighbor. On Your Side.

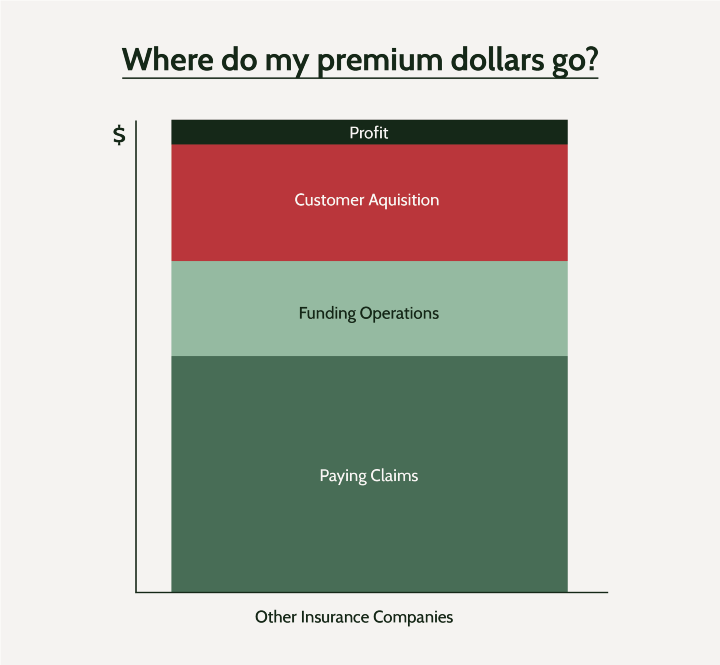

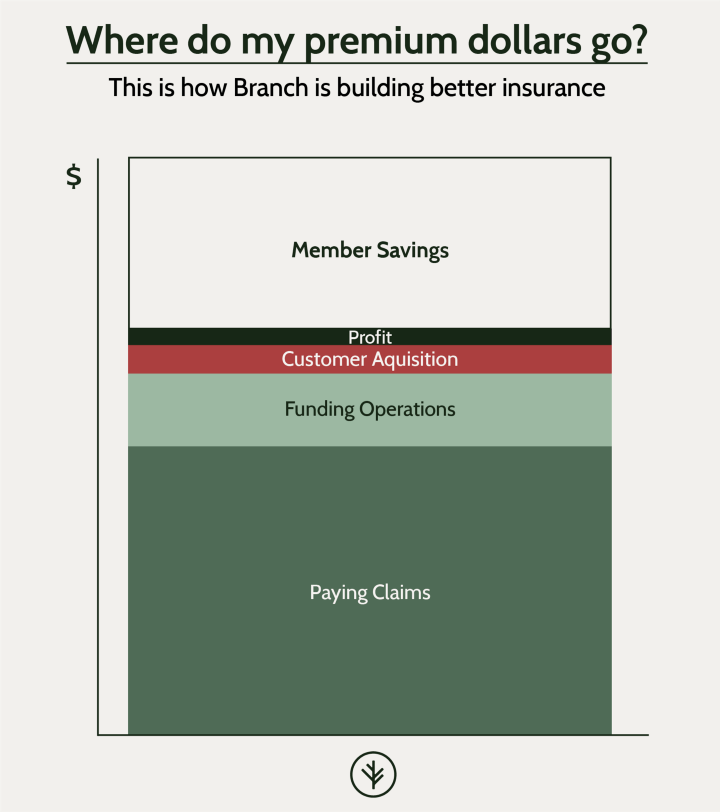

You know all the tag lines and jingles because you’ve been relentlessly marketed to for as long as you can remember. The reason for this is simple (and it isn’t that you clamored for commercials about emus). The insurance industry knows that it can acquire more customers if it spends more money. In fact, every year, $40B is spent by insurance companies to acquire customers, an expense that is continuously funded by their current customers.

You might be saying, “Yes, but every product has acquisition cost baked into its price, so what?” If you’re asking that question, rethink the paradigm with me. Insurance isn’t like buying other products — it’s not like buying a car, phone, or toy. The industry has a “batteries not included” problem. Batteries not included is when you got a fantastic toy as a kid only to read on the box “batteries not included” and then spent every waking minute begging your parents to take you to the store.

Can you imagine buying a battery for your smartphone or most anything else you purchase today? Why is it that when you buy a house or car that you’re required to insure, insurance isn’t offered in that moment of relevance? You didn’t need insurance before you bought the car. You can’t drive the car without insurance. This is the structural problem that surrounds us. Insurance is one of the highest ad spending industries, but insurance doesn’t deserve the limelight any more than the battery in your smartphone does. The marketing warfare is fundamentally wrong and is at the time and expense of consumers. Branch is here to change all of that.

It would be more convenient if insurance were offered in relevant moments, but it would also empower us all with information. Did you know that the price of your insurance affects what a mortgage lender can lend you? The lender is forced to guess what your insurance will cost as a part of their pre-approval value, but the estimate can lead to hairy situations (or worse!) trying to close on your dream home. Home security providers forever have said, “If you buy home security, you might get a discount on your home insurance offsetting the cost for home security.” Wouldn’t it be useful to know the total cost of owning a home security system given you deserve to spend less on insurance for reducing your risk?

Insurance offered in relevant moments would be more convenient and it would be information-empowering, but who wants to go through hundreds of questions to get a quote estimate for insurance while in the midst of purchasing another product? Can you imagine if you were asked a hundred questions about the new countertops being installed in the home you’re buying? Insurance hasn’t been offered in moments of convenience, the way it was always destined to be distributed, because technology and underwriting hadn’t been built to make insurance a net positive within the primary transaction, until now.

We built Branch differently so we can offer home and auto insurance using just a few pieces of information — just a name and address. And rather than giving consumers phony quotes that are subject to change, we serve only real prices, so you can offer insurance digitally, instantly, and even through an API. It can be this easy.

Offered in relevant moments, insurance can be convenient, it can be information-empowering, and it can be easy, but the coup de grâce is that for the first time, insurance can be distributed unburdened by acquisition cost. For the first time, it can reach new heights of efficiency. Through Branch, insurance is made less expensive. No tricks. No gimmicks. The price doesn’t double right after you click the “buy” button. It’s a structural change to the product. It’s a structural change to the model. It’s a change to the way we all should think about how insurance can be better… it can be good. The batteries are in the box. Making insurance less expensive is Part 1 of our mission, and we think it’s really good.